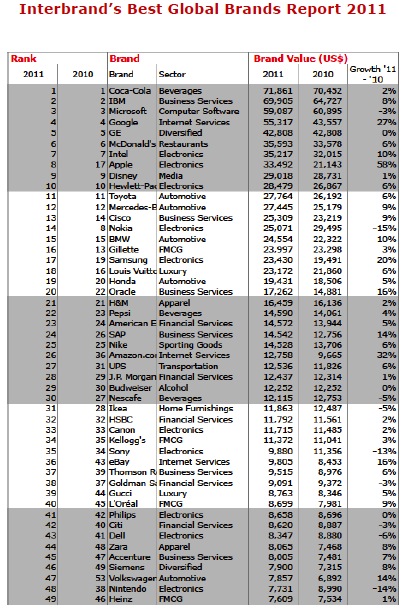

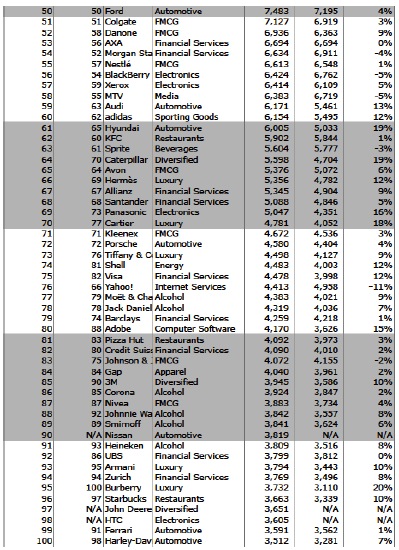

Interbrand announces 12th Annual ‘Best Global Brands’ with Coca-Cola holding number one spot

Interbrand today announced the 2011 Best Global Brands report with Coca-Cola topping the list for the twelfth consecutive year, and Apple becoming this year’s top riser, with a brand value that has increased a staggering 58 per cent.

Interbrand today announced the 2011 Best Global Brands report with Coca-Cola topping the list for the twelfth consecutive year, and Apple becoming this year’s top riser, with a brand value that has increased a staggering 58 per cent.

Says Damian Borchok, CEO, Interbrand Australia and New Zealand: “Interbrand’s Best Global Brands report is a reflection not only on how brands are performing in terms of their perceived brand success, it is also an invaluable tool for to detect how consumers are behaving, evolving and reacting to brands. More than ever, the economic climate, and consumer movement alike are demanding brands to be flexible, innovative and to explore social spaces they have never dared to before.”

TECHNOLOGY STILL DOMINATES

This past year, technology brands continued to show sector-wide growth. Seven of the top ten brands (IBM, Microsoft, Google, GE, Intel, Apple and Hewlett-Packard), four of the five biggest risers (Apple, Amazon.com, Google and Samsung) and one of the few new entrants to the Best Global Brands report (HTC, the mobile device maker in Taiwan) all hail from within the tech sector.

- HTC (#98) made its first appearance in Interbrand’s Best Global Brands report this year. HTC, a company that recently shifted from B2B to B2C, is focusing on increasing consumer awareness, establishing partnerships with more established brands and enhancing its digital brand strategy – all of which make it one to watch in the year ahead.

- IBM (#2), one of the leading global B2B companies, showed very strong performance this year, underpinning the increasing importance of brand in the B2B space – It’s performance a strong indicator that well-defined corporate citizenship strategies, like Smarter Planet, can become very valuable business assets.

- Amazon.com (#26) has become one of the world’s strongest brands, in record time, jumping 32 per cent in brand value year-over-year. Much of Amazon’s recent success can be directly attributed to its strong sales of the Kindle and e-books.

“Technology brands are a good example of a market which is leading the way in terms of responding to consumer demand and listening for insights to guide product development,” said Damian Borchok, CEO, Interbrand Australia and New Zealand.

RESILIENT AUTOMOTIVE BRANDS

Remarkable growth in the auto industry was driven primarily by an economic recovery in classic European markets, a resurgence of the US automotive industry and high demand for cars in China.

- Nissan Motor (#90), Japan’s second largest carmaker, returns to Interbrand’s Best Global Brands report for the first time since 2007. Nissan was able to restock inventories faster than its competitors immediately following the earthquake that devastated Japan last March.

- Toyota (#11) retains its position as the #1 automotive brand in Interbrand’s 2011 report. Even though Toyota faced both an internal crisis (lack of quality control in 2010) and an external crisis (Japan’s earthquake), it exhibited great resiliency, increasing its brand value by six per cent, by focusing on safety and quality, modifying its leadership structure and capitalizing on its world-renown green efforts.

CONTINUED COMEBACK FOR LUXURY BRANDS

Luxury brands appearing in Interbrand’s report were able to increase their respective brand values by striking a delicate balance in 2011: leveraging their iconic status and simultaneously engaging new consumers in unique and relevant experiences.

- Corporations such as Louis Vuitton (#18), Gucci (#39), Hermès (#66), Cartier (#70), Tiffany (#73), Moët & Chandon (#77), Armani (#93) all saw their respective brand values increase this year.

- Most notably, Burberry (#95) increased its brand value by 20 per cent, making the British luxury retailer one of the top risers in this year’s report. Burberry bested other luxury brands by focusing on its core competencies in fashion, digital innovation and global expansion.

FINANCIAL SERVICES’ SLOW PATH TO RECOVERY

Following the 2008 financial crisis, certain financial brands continue to struggle – particularly those financial brands based in the US.

- Legacy banking brands Citi (#42), Barclays (#79), Credit Suisse (#82) and UBS (#92) saw slight declines in brand value in Interbrand’s 2011 report.

- Certain European-based financial institutions, however, saw brand values climb five per cent or more within the past year. Zurich (#94) from Switzerland, as well as Spanish banking giant Santander (#68), all seemed deeply committed to restoring consumer trust and reestablishing strong business ethics.