NAB breaks up with ANZ, Commbank, Westpac with cheeky campaign via Clems Melbourne

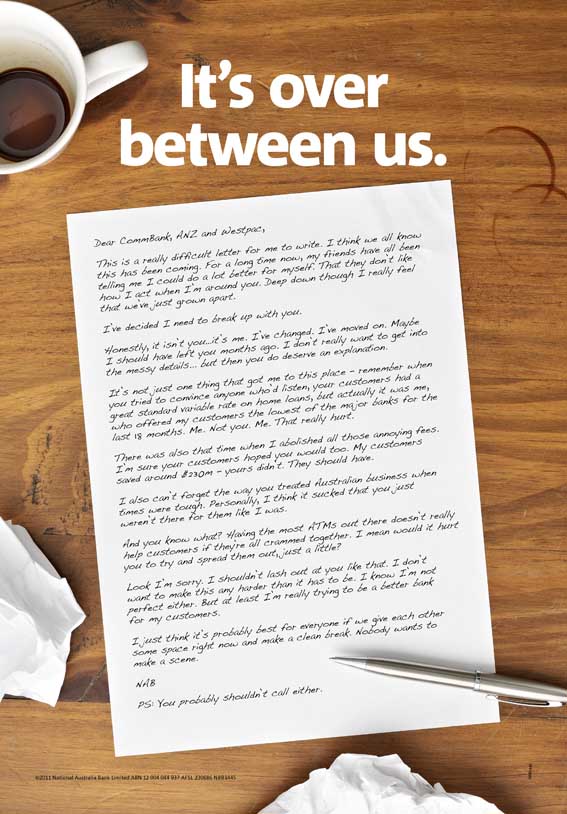

NAB, via Clemenger BBDO Melbourne, has launched a cheeky campaign which revolves around a public break-up with the other major banks – ANZ, Commonwealth Bank and Westpac – and will use a variety of creative and tactical executions to communicate to existing and potential customers.

NAB, via Clemenger BBDO Melbourne, has launched a cheeky campaign which revolves around a public break-up with the other major banks – ANZ, Commonwealth Bank and Westpac – and will use a variety of creative and tactical executions to communicate to existing and potential customers.

The large-scale multi-platform campaign has seen an initial launch with a publicity and social media program followed with a Valentine’s Day stunt which took place last night.

The large-scale multi-platform campaign has seen an initial launch with a publicity and social media program followed with a Valentine’s Day stunt which took place last night.

Sixty couples publicly broke up in restaurants, bars, and public spaces across Australia in the evening of February 14th. The content was filmed and seeded online before the ATL campaign launched today, 15th February with full-scale ‘break-up’ activity.

The campaign also extends to press, Adshel, large format outdoor, radio, mobile billboards, street teams, street chalking, helicopter banners and video. Consumers will be directed to breakup.nab.com.au where they can interact with the campaign and keep up to date with the latest activity as it breaks.

NAB’s Facebook page and YouTube channel will also provide forums for consumers to interact with the content and share their views.

The campaign launches on the back of 20 months of significant action where NAB has driven competition in the marketplace via a series of customer-focused initiatives. Some of these actions have included:

* Offering CBA and Westpac customers help in switching their mortgages to NAB’s lower standard variable rate by paying the $700 mortgage early exit fee charged by CBA and Westpac when customers switch their mortgage to NAB

* Abolished monthly Account Service fees on the most popular personal transaction accounts

* Maintained the lowest standard variable mortgage rate of the major banks for the last 20 months

* Alliance with RediATM to double the ATMs network for customers

* Changed credit card payment hierarchy, resulting in lower interest payments for customers

* $1000 buffer for all overdrawn (reference) fees to help businesses with cash flow.

Client: NAB

Agency: Clemenger BBDO, Melbourne

Creative Chairman: James McGrath

Executive Creative Director: Ant Keogh

Executive Planning Director: Paul Rees-Jones

Creative Director (Copywriters): Rohan Lancaster, Julian Schreiber

Creative Director (Art Directors): Darren Pitt, Tom Martin

Group Account Director: Simon Lamplough

Account Director: Kelly Richardson

Account Manager: Kate McCarthy

Executive Producer: Sonia von Bibra

Production Company: Will O_Rourke

Media: Zenith Optimedia

PR: Bang PR

49 Comments

So…they’re admitting they’ve all been in bed together all along?

Yawn! Me thinks the top 4 should stop spending lots of money bitching about each other and actually do something productive to make their customers actually satisfied with the service.

I hope this gets what it deserves. An absolute pasting.

Total crap.

What is the intended outcome of this? More people move to NAB?

Nothing about this campaign tells me why I should move all my accounts from Westpac to NAB. If anything it shows that my money will be spent on massive, worthless advertising campaigns.

Pathetic.

This is the combined efforts of a top tier bank and a top tier agency?

Who would bother writing a break up letter to an asshole bank?

@nab – number one trending topic on twitter at the moment.

It’s all kinda lame, but it probably works to get the main message across to the consumer that NAB is different from the others.

That’s as long as you have the patience to follow it all through. All the videos were a waste of time though.

Pretty fresh iattempt that will cut through the oh so dull and safe and same-same Aussie bank work. And get NAB talked about. And get people thinking, even just a little. And that’s half the job.

I’ve worked on five different banks in the past year. This is pretty good. Hats off for having a go.

I like it.

They want to not be part of the “Big 4”, and this separataion tactic suits the objective.

Now they’ll just have to “nab” the swaying bankers…

would I be able to cahrge the bank $38 for my break up letter like they charge me for an automatically printed letter and postage stamp whenever my account goes overdrawn.

Where’s the promise and payoff? I get commonwealth they say they’re different, now NAB says they’re different but how? they rip people off and produce shit campaigns they’re all the same, at least bankwest has a go at being different not just says it is.

If any of the idots slagging this off actually took the time to engage with the full scale of this campaign they might realise what an achievement it is.

This is fresh and innovative for the category and should be applauded.

And no, I didn’t work on it.

3.25 they abolished overdrawn fees (and lots of other annoying fees) ages ago you tool.

http://www.nab.com.au/wps/wcm/connect/nab/campaigns/personal/101/2

Maybe you should check your bank statement and see which bank you’re actually with.

Terrible. It’s the sort of shit I’d come up with.

PS. Anyone (12:36) who starts a message with ‘Me thinks…’ eats a lot of cock.

I’d quite like to separate from most of the contributors to this blog thread.

I wonder what the camera would catch them doing…

Depends if they follow through and continue to actually behave like a non bank. If so, bravo. If not, FAIL.

It’s got everyone talking, well beyond this blog. Hats off.

Just quickly – industry community response to this campaign

BandT – no comments

AdNews – no comments

Mumbrella – fairly positive response

Campaignbrief – usual set of whining egos

Cheer up –

At least they can take a solid idea through the line properly.

For NAB – probably one of the most PAINFUL clients around, it’s good. Thank god they didn’t do it all with vectors and Harry the seagull.

Oh and we know where you work Anonymous.

Flawed strategy with big $$ wasted on it.

3.42 – when you say the full scale of the campaign – are you applauding the fact that the agency managed to get a load of shit through the client?

I like Tom, Jules, Ant and co, I really do, so I say this with the upmost respect:

Please, art directors around the country, if you’re going to make something look hand written, for the love of the God’s of Advertising and Typography, don’t use a font.

It looks painfully bad.

That aside, I like the idea.

All i got to say is

“shooow meee the money!!”

Who gives a fuck about you breaking up with westpac. Firstly i didn’t knew you were in bed with westpac, and Why do i care. How is my banking going to be better because you’re not with them anymore.

It’s not about trending, and getting talked about you morons. It’s about being relevant!

I liked “happy banking” the happy banking campaign. it didnt made me change banks but it made a good impression from that brand.

Having being dumped by many gf’s in the past, i can say that IT SUCKS and the PERSON WHO DOES THE DUMPING and BRAGS ABOUT IT are dickheads.

Meet NAB the Dickhead of the top 4.

oh god that’s really really really awful. how depressing that the best agency in the country can up with such a lot of cringe-able RUBBISH. and the revolver people as well. where to now, then, under the lowest bar set for quite a while?

Cringe-able. Since when was that a word?

You cocks are lame.

Good campaign. All over the news today. Anyone else here has their ads talked about on a national stage as much as these have been today?

Thought not.

Rubbish X10.

They are a bank. And a bad one.

Nothing will convince me of their, ‘More give. Less take’ position.It should read the other way around.

And after 20 years of flagrant money-grabbing I fired them.

Didn’t even bother with a letter.

For the category it is quite fresh and well executed (though I agree with 6.23 – why oh why use a font when you are trying to make it look handwritten..?)

The fact that the surrounding mainstream PR has lasted 4 days so far (on the non-commercial ABC website as I write) and outlasted the normal ‘cheeky brand favourite’ Virgin says it all really.

Client and teams involved should be proud.

Just because some nice guys from that agency you all think can’t do any wrong, did this work, doesn’t make it any better.

Even with this category breaking opportunity from the client, their best was to come up with a break up letter!

Lazy creative. Sorry nice guys at mostly god agency.

Say what you will about the idea, the client sure as shit got their money’s worth in terms of press coverage. Every radio station, every paper and ever TV channel was all over this.

Listen and learn, haters. You can pick this apart on logic, originality and art direction, but as 8:44 and some others have noted, this campaign has been all over the TV news, the print news, radio, on-line and wherever else, reported as a public interest story and daily news event. Including this morning. What don’t you juvenile haters get about what how advertising works and what it’s supposed to do? If I’d worked on this, I’d be thrilled to bits at the sheer amount of free media this campaign has attracted. I’m personally impressed at the thoroughness with which the idea – whether you like it or not – has been developed boldly across a range of executions, including a helicopter banner and huge building sites. Have some perspective. It’s what happens to your work outside the bubble of the advertising community and the CB blog that really matters.

Can one of the strategy people on this blog explain to me why NAB would:

1) Reinforce that the big four banking industry is full of banker wankers.

2) Reinforce they have been involved in a relationship with each other to the betterment of their shareholders but to the detriment millions of customers.

3) Not promote a positive agenda about themselves like Com Bank (Determined to be different) and Bank West (Happy Banking).

How does this help the NAB or Banking Industry?

You’re right Ben, they did get their money’s worth. The agency has done their bit.

Soon the dust will settle and we’ll read about NAB claiming some fantastic new number of people who’ve left other banks for them. But like anything with risk attached, they are just as likely to end up the loser as the winner. They’ve started a fight they have to be prepared to finish and ads, no matter how good, can’t do that for them. Eventually the truth of their products and service claims will be clear to everyone. And as Bill Bernbach once said [not accurate], “Good advertising for a bad product just means more people know you have a bad product faster”. Right now, we’re talking about the advertising, soon we’ll be talking about the products. And if the’re not as good as claimed or inferred i’s conceivable the other banks will just take it in turn to belt the hell out of the NAB and their products. NAB might find themselves fighting fires on every front – home loans, credit cards, insurance, fees. They could end up victorious, or retreating to their no.4 spot licking their wounds. It’ll be interesting to watch. Only this time, the only sure thing is that the banks agencies, not the banks, will be the winners. Let the games begin!

Word.

Top story on The Age online this morning. You can’t buy that. Kudos.

What a joke. We just moved 3 mortgages and multiple transaction accounts because their customer service is sooooo bad. We gave them many opportuntiies to fix problems but it seem that across every division of NAB no one gives a toss unless they are getting a direct benefit eg. move your existing loan to a new one so they get their commission all over again. They should scrap the crap campaigns and focus on training their staff to actually listen to customers and follow through on their advertising promises. This is one bank I will never bank with again regardless of how low their interest rates are. Yet another joke of a campaign from a company who has no idea of what customer service is. The other 3 banks must be laughing!

Brilliant.

Strong. Simple communication.

Putting their balls absolutely on the line.

If they live up to their word this will truly change things.

Anybody who doesn’t understand how strong this is as an advertising idea doesn’t deserve to be out of AWARD school.

grow up.

This is SHIT. Everyone’s shit. My mum could do better than this and she is dead. It is so bad I physically stabbed my eyes out with a burning stake.

Fuck banks.

Jesus tapdancing Christ I’m awesome.

Properly executed, this strategy could work for one of the smaller banks or one of the non-bank lenders.

But for one of the big banks, it’s absurd.

As many have said here, that press ad is a confession – it’s saying, hey, we’ve screwed you for years, but now we’re going to stop screwing you. Promise.

Not likely to get a good response, and not likely to be believed. Zero credibility.

It smells of “New Julia” and we know how well that went.

The only thing that saves the ad from being totally counter productive is that no one will read it. No one. It’s too long and drawn out. It’s a waste of space.

Personally, I think it’s time for the big banks to stop apologising for being successful. They actually have a good story to tell in terms of stability and competitiveness (none of the small players are actually cheaper in any way).

Or do people really want more banks like the State Bank of Victoria, the government owned bank that went broke less than 20 years ago?

1:29 – have you been hiding under a rock for the last few days?

‘not likely to get a good response’…’not likely to be believed’..etc. etc.

If you venture outside into the big wide world you’ll see it’s doing really rather well. If you then ventured into the offices of ANZ, Westpac and Commonwealth Banks you’d find it’s hit the mark there too.

As for nobody reading the letter, would the fact it was read out on multiple national news programmes help? Or what about the fact it was read out verbatim on multiple radio stations too? Or how about the fact a recorded version of it has had more than 50,000 views on YouTube at the last time of checking. I’d suggest your description of it as a waste of space is misguided.

For your clients sake I hope you have a better radar when it comes to judging your own work. Your ability to judge others wouldn’t seem to be all that hot.

Dear 1:29,

I hate to break it to you, but “not likely to get a good response” refers to the likelihood of people actually believing the NAB ads and acting on them.

The only bank offices that are responding are the offices of various marketing departments – and bank agencies, who love a good ad war to bring in the dollars.

Actual customers are unaffected. That’s the real “real world” that we ad people seem to avoid discussing too often.

Let’s see what actually happens – if NAB customer numbers go through the roof, I’ll send you a formal apology. But it will take me less than 300 words.

PS: And just because it’s read out on the radio doesn’t mean anyone listened. Dumb and boring is still dumb and boring, whether the words are in print or spoken.

It’s up there with the Yetti

Truly, what do you think this campaign is about?

Regardless of whether you think its pox or stupid or a lame attempt, whats the marketing move here?

What do you think they are aiming to acheive?

I love the you tube video, nab “bankers break up in st kilda”

NAB recently announced the campaign which so many of you pricks hung shit on has attracted 225,000 new customers and counting.

Must be shit then.

Cannes Grand Prix.

I’m with 7:56

First bank to win a Grand Prix since the 1970’s. Well done Clems, well done NAB, stick it up your bum everyone else.

They’re clearly colluding and just take it in turns to be the good guy or the shit kents. I can’t believe they’re tactics have made it all the way down to a brand brief and exposing their game so much. They’re betting on the fact the average Australian lacks the ability to think critically…