Marketers gain cross-channel ad spend data with SMI product categories tripling across all media

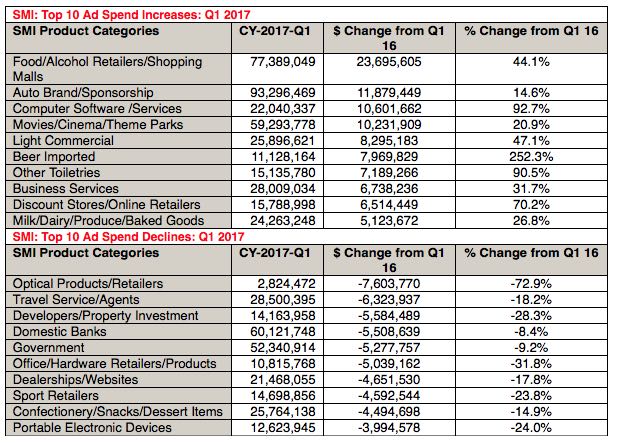

Marketers now have unprecedented visibility into actual advertising expenditure in their specific markets for the first time ever, with Standard Media Index (SMI) tripling the number of product categories for which it provides data to 126.

Marketers now have unprecedented visibility into actual advertising expenditure in their specific markets for the first time ever, with Standard Media Index (SMI) tripling the number of product categories for which it provides data to 126.

And in another first, SMI data will also show cross-channel expenditure for each media type: TV, radio, out-of-home, newspapers, magazines, digital and cinema.

These enhancements mean marketers need no longer rely on estimates within broad market sectors and key markets, such as electrical retailers, discount stores, credit cards, auto insurers and airlines, will know the size of their market’s actual ad spend for the first time. Historical data back to 2007 is now available.

For example, an airline advertiser will know, to the dollar, actual ad spend within their specific segment, rather than have to estimate based on overall travel category figures.

Armed with knowledge of the true size of their respective markets, advertisers gain powerful advantages including:

Armed with knowledge of the true size of their respective markets, advertisers gain powerful advantages including:

More efficient advertising investment. Through clear understanding (not estimates) of their respective share of voice, marketers can calculate media loadings based on their preferred share of actual voice rather than guesswork.

Improved media planning. Each month marketers can track where their industry advertising spend occurs, to make informed decisions whether or not to follow emerging or continuing trends.

Unprecedented benchmarking. Expanded SMI category and cross-channel data provide marketers the missing tool in their return-on-investment arsenal, as they can now measure themselves within their specific sector.

SMI AU/NZ managing director Jane Schulze said the days of relying on rubbery estimates are gone.

Says Schulze: “In 2017, in an industry as sophisticated as media and marketing, it’s crazy that large advertisers still plan and develop strategies based on estimates which everyone knows are inaccurate and practically unusable for digital.

“The industry has only operated on this basis because ‘if estimates are wrong for everyone, and they’re all we have, then that’s OK.’ SMI is determined to change that thinking, because marketers need and deserve something better.

“Through proactive collaboration with our media Agency partners, SMI is delivering accurate, granular data in a safe environment, where individual campaign rates remain masked. That means advertisers have real, competitive market detail across all major media, every month, and they can stop using flaky estimates in campaign planning and analysis.”

Schulze added SMI already provides never before seen detailed data on each of the 126 product categories for digital media, encompassing: digital sector (programmatic, search, social, content sites, etc); digital ad format (video, display, mobile, etc); digital buy type (third party, direct) and Website genre (news/weather sites, sport sites, business sites, etc).

Says Jodi Fraser, commercial director at Publicis Media Exchange: “These changes will give clients a greater understanding of category media trends. Competitive reporting in the past has either been limited by the accuracy of the reported data or the ability to see more defined categories. Now clients will be able to understand their actual share of voice within their category which will allow for greater planning insights.”