Apple most valuable brand in the world – BrandZ Top 100 Most Valuable Global Brands study

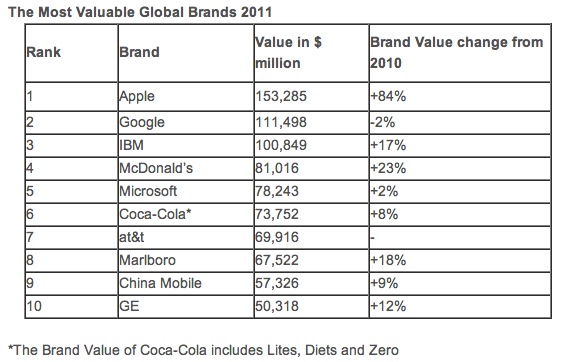

Registering a staggering 84 percent increase in value over the past year, Apple has emerged as the most valuable brand in the world, ending the four-year reign of Google at the top of the table in the sixth annual BrandZ Top 100 Most Valuable Global Brands study.

Registering a staggering 84 percent increase in value over the past year, Apple has emerged as the most valuable brand in the world, ending the four-year reign of Google at the top of the table in the sixth annual BrandZ Top 100 Most Valuable Global Brands study.

The Apple brand, as calculated by Millward Brown Optimor, a WPP company, has increased in value by 859 percent since 2006 and now stands at $153.3 billion. Other key findings in the study are that during the economic recovery of the last year, the combined value of all the brands in the top 100 has risen by 17 percent and is now worth $2.4 trillion. In terms of geography, according to the 2011 BrandZ study, 19 of the Top 100 brands now originate in “BRICs” markets, versus only two in 2006.

“Nine of the top ten brands have a strong brand history or presence in Australia,” said Martin Attwood, Senior Account Manager of Millward Brown Australia. “This has elevated the importance of building brands among the world’s most successful companies. CEOs and CFOs should be asking their marketing teams how they can leverage brand to both protect and grow the business. Strong brands, while not immune to the vicissitudes of the market, are more protected, prepared, resourceful and resilient.”

“Nine of the top ten brands have a strong brand history or presence in Australia,” said Martin Attwood, Senior Account Manager of Millward Brown Australia. “This has elevated the importance of building brands among the world’s most successful companies. CEOs and CFOs should be asking their marketing teams how they can leverage brand to both protect and grow the business. Strong brands, while not immune to the vicissitudes of the market, are more protected, prepared, resourceful and resilient.”

The BrandZ Top 100 Most Valuable Global Brands study, commissioned by WPP and conducted by Millward Brown Optimor, identifies and ranks the world’s most valuable 100 brands by their dollar value, an analysis based onfinancial data combined with consumer measures of brand equity.

“Our brand valuations are a powerful measure of an organization’s ability to create real and lasting value for shareholders.” said Eileen Campbell, CEO of brand research company Millward Brown. “By nurturing its brand and constantly innovating, Apple is able to command a high price premium and weather economic turbulence, providing a global business success story that other brands can learn from.”

“Business leaders can embrace brand management as a critical competency for building long-term financial value,” she added. “Compared with an overall improvement of 13 percent in the world’s equity markets during 2010, the best brands grew their value 30 percent faster.

Other key findings highlighted in this year’s research report include:

One in five brands is from the BRICs: This year, 19 brands come from emerging markets compared to two in 2006 and 13 in 2010. The growing presence of brands from BRICs in this global ranking highlights the expanding purchasing power of people in these countries. While many of these brands are buoyed by the size of their local customer base, many more now have international ambition including Petrobras in Brazil (No. 61 in the ranking with a brand value of $13.4 billion); ICICI Bank in India (No. 53 and worth $14.9 billion) and China’s largest search engine Baidu. Now listed on the NASDAQ index, Baidu has a brand value of $22.5 billion and moves up 46 places in the ranking to number 29. Despite these successes, consumers in the BRIC regions continue to favor Western brands. Louis Vuitton, for example, (for which Brazil is its second-largest market) benefited from the new energy and confidence in the BRICs region. Its 23 percent growth in brand value to $24.3 billion has helped this luxury retailer achieve 26th place in the ranking, a three-spot increase from 2010.

Heritage brands stay relevant in a technology age: Coca-Cola (No. 6), GE (No. 10), IBM (No. 3) and McDonald’s (No. 4), stand out in this study of global brand strength as brands that have survived for more than 50 years. Leadership, strategy and tactics aside, what all of these companies have in common is their use of brand to remain relevant to consumers and drive global business success.

Technology and telecom brands dominate the ranking: Technology brands, which make up one-third of the Top 100 brands, continue to demonstrate their relevance in our daily lives. While Apple leads the ranking, it is followed in second place by Google, with a brand value of $111.5 billion, and IBM in third place with a brand value of $100.9 billion. Facebook makes its debut in the Top 100 ranking this year at No. 35 with the highest increase in brand value, 246 percent, making the brand worth $19.1 billion. Online retailer Amazon also edged past Walmart to become the No. 1 retail brand and 14th overall, with a 37 percent rise in brand value to $37.6 billion.

Fast food, luxury and technology brands led brand value appreciation: Each of the13 market sectors covered in this study grew in value over the last year. Fast food led the sector growth (22 percent) followed by luxury (19 percent) and technology (18 percent). The oil and gas sector experienced the slowest rate of growth (1 percent).

Tech and convergence create brand interdependencies: Brands are ever more dependent on their use of technology to win consumers’ hearts and minds. The brand values of Burberry, Chanel, Louis Vuitton and Coca-Cola all benefited from their use of technology for example by harnessing social media and apps. At the same time, the dependencies demonstrated in the physical world between applications, devices and operating platforms are creating similar branded interdependencies. Brands that are aware of the risks can leverage these associations to drive value and growth.

Toyota reclaims position as most valuable car brand demonstrating the power of strong brands to recover from the most fundamental challenges to product efficacy and reputation. Toyota’s brand, which is rated by consumers as “great value,” rose 11 percent to $24.1 billion.

The BrandZ Top 100 Most Valuable Global Brands study is the only valuation in the world that takes into account what people think about the brands they buy alongside rigorous analysis of financial data, market valuations, analyst reports and risk profiles. The research report, which is available online, includes a ranking and analysis of the Top 10 most valuable brands for key regions of the world and 13 market sectors. Download the complete BrandZ ranking, including regional and category breakdowns. The rankings and a great deal more are also available as a free application for the iPhone, iPad, Nokia, BlackBerry and Android from www.brandz.com/mobile

3 Comments

Apple’s rise and rise may seem overblown to some. But I think it should clearly be at the top of any list going.

Apple’s share price may seem high as a kite, but it actually should be flying much much higher. It is undervalued. And I can assure you it will keep growing at these and even higher rates. And I can explain why.

Apple’s share price has been trading at a P/E of 16.3. Excluding cash that ratio was at 13. On a conservative forward basis (my estimates) the stock is priced at less than 10 times next twelve months’ earnings. Many other in favour share prices are traded at up to 30 times earnings.

These figures show a remarkable pessimism that has persisted around Apple for years. It persisted when Apple was growing at 30% of, as now, 95% annually.

Why is Apple so undervalued when we know the ever more connected universe is just starting to become Apple devotees (note the growth path in China alone).

Some say that number two on the list Google and it’s Android has been the key factor in the Apple stock being undervalued.

Lately it’s become fashionable to credit Android with overtaking Apple’s IOS. But Apple has not “lost sales” to Android as it has been selling all it can produce.

Since Apple is trading at a fraction of it’s historic multiple, it’s multiple based on growth, and comparable companies’ multiples then we can assume that a “normal” valuation should be twice the current (i.e. a multiple of about 32).

But a multiple of 32 would imply a doubling of its Market Cap, so Apple should be valued at $600 Billion US.

And if the Android factor is indeed the factor that is stopping Apple being valued fairly the solution could be simple. Since Google (Android’s owner) itself is only worth about $169 billion. Apple could buy Google (it already has a third of its value in cash) and it shut down Android, and it would create $300 billion in extra value.

It could even throw away all of Google and still walk out with a profit.

Just an idea.

Paul G Roberts

Author of the Book and part of his Trilogy

NOW A Business Survival Guide (on sale everywhere)

http://www.youtube.com/watch?v=GhkqjyCNgoE

Ok most valuable brand. Not against that result but somehow an alarming concern of workers in Apple affiliated company makes the quality of their workforce service ethically questionable. Read this http://www.triplepundit.com/2011/05/report-details-abuses-chinese-factories-manufacture-apple-hp-products/

I would agree and disagree in some instance.