MAGNA Forecast: APAC advertising records +7.9% growth in 2024, led by China and India

The Asia Pacific advertising market continues to show resilience and momentum despite broader global economic uncertainty, according to the Summer Update of MAGNA’s Global Ad Forecast released today.

The region’s ad economy grew by +7.9% in 2024 to reach US$288 billion, with real GDP up +5.3%. While growth is expected to moderate slightly in 2025, APAC remains a key driver of global ad spend — led by China and supported by strong performances across markets like Australia, India, Japan, and South Korea, which together account for 87% of the region’s total revenues.

Says Ros Allison (pictured), Head of Product & Innovation, MAGNA Australia: “Some return to growth evident for the Australian market in 2025. Early recovery in H1 and strong market fundamentals despite some dark clouds of geopolitical upheaval and tariff uncertainty. Digital platforms dominate the Australian market, taking over three quarters of ad revenue. Renewed positivity for Traditional Media Owners – including their digital assets – with stabilisation of TV audiences, growth for streaming and podcasting, and a standout market for OOH vendors.”

In 2024, Australia had a GDP of $1.7 trillion, making it the world’s 17th largest economy, and a population of 27 million (28th globally). The advertising market (measured as media owners’ net ad revenues) totalled AUD 28.4 billion ($17.6 billion) in 2024, placing Australia as the 7th largest ad market worldwide and the 5th most intense on a per capita basis, with $648 in ad revenues per person (global average: $159).

Digital formats continue to dominate, representing 76% of total advertiser sales. Television, while historically significant, fell to 13% share—down from 21% pre-COVID in 2019. The retail vertical remains Australia’s largest, followed by telecoms and finance. Among the country’s top advertisers were Woolworths, Harvey Norman, Amazon, Wesfarmers and the Federal Government.

On the regulatory front, the Australian Competition and Consumer Commission (ACCC) has taken several steps to address digital platform dominance, additionally the government’s social media restrictions—specifically an under 16 teen usage ban passed in late 2024—is expected to come into force at the end of 2025. In measurement, the introduction of VOZ, as Australia’s new linear free to air TV currency, has enabled cross-platform analysis across linear TV and BVOD.

Social Media Leads the Way

In calendar 2024, Australia’s advertising market grew by +5.7% year-over-year, reaching AUD 28.4 billion ($17.6 billion). This growth occurred alongside nominal GDP growth of +3.9% (comprised of +1.0% real GDP and +3.2% inflation). Inflation has now eased to 2.4%, within central bank target range.

Digital Pure Players (DPP) led the expansion, with revenues rising +9.2% to AUD 21.6 billion ($13.4 billion), or 76% of the total. Within digital, search grew +5.0% to AUD 10.4 billion ($6.5 billion), social media surged +19.1% to AUD 7.6 billion ($4.7 billion), digital video increased +4.9% to AUD 2.3 billion ($1.4 billion), and static display declined -1.8% to AUD 400 million ($200 million).

Traditional Media Owners (TMO) saw ad revenues fall -3.9% to AUD 6.8 billion ($4.2 billion). TV advertising dropped -6.5% to AUD 3.7 billion ($2.3 billion); publishing declined -6.4% to AUD 600 million ($400 million); audio fell -8.6% to AUD 1.1 billion ($700 million); and OOH grew +9.1% to AUD 1.3 billion ($800 million).

Beyond market performance, structural changes reshaped the landscape. Consolidation continued, with Newscorp selling Foxtel to international streamer DAZN and SCA divesting its regional networks to the Ten Network.

Conditions for improvement in the Australian ad trading market remain positive, with relatively strong fundamentals. The volatilities surrounding US tariffs, and geopolitical upheavals causing some shortened market visibility and potential for uncertainty through 2025.

Search and Social = 2/3 of Ad Spending

MAGNA expects total advertising revenues in Australia to grow by +5.4% in 2025, reaching AUD 29.9 billion ($18.5 billion), again making it the world’s 7th largest ad market. The IMF projects a macroeconomic backdrop of +1.6% real GDP growth and +2.6% inflation.

Digital media will continue to expand, with revenues reaching AUD 23.0 billion ($14.3 billion), growing by +6.7% and increasing share to 77% of total ad sales. Within digital, search will grow +3.5% to AUD 10.8 billion ($6.7 billion), social media will climb +14.3% to AUD 8.7 billion ($5.4 billion), digital video will grow modestly by +1.0% to AUD 2.3 billion ($1.4 billion).

TMO revenues will total AUD 6.9 billion ($4.3 billion), up +1.1% year-over-year. TV will decline slightly (-0.7%) to AUD 3.7 billion ($2.3 billion), with audience losses stabilising. OOH will remain a growth standout, digitisation and innovation promoting sector growth, +10% to AUD 1.5 billion ($900 million). Audio flat overall with growth for podcasting and streaming, +0.2% to AUD 1.1 billion ($700 million).

While the market’s short-term outlook is shaped by geopolitical and cyclical factors, long-term momentum will be driven by digital media scale, a consolidated media owner landscape, and Australia’s enduring role as one of the most advanced advertising economies in the world.

Digital Pure Players Drove APAC Growth in 2024

The advertising economy in Asia Pacific grew by +7.9% in 2024 to reach $288 billion. This took place in a stable economic environment, with real GDP increasing by +5.3% in 2024. While this growth is expected to slow slightly in 2025 to +4.5%, the growth environment has been conducive to brands deploying ad budgets. Inflation in APAC has continued to decline and while some economies are still seeing sustained price pressures, others are facing deflationary risks. While this was increasing the possibility of a soft landing for the Asian economy, there is now the threat of trade wars and geopolitical uncertainty that is causing additional hesitation from brands. This is one of the reasons why growth expectations in 2025 are significantly lower when it comes to ad spending (+4.6%, down from +7.9% growth in 2024).

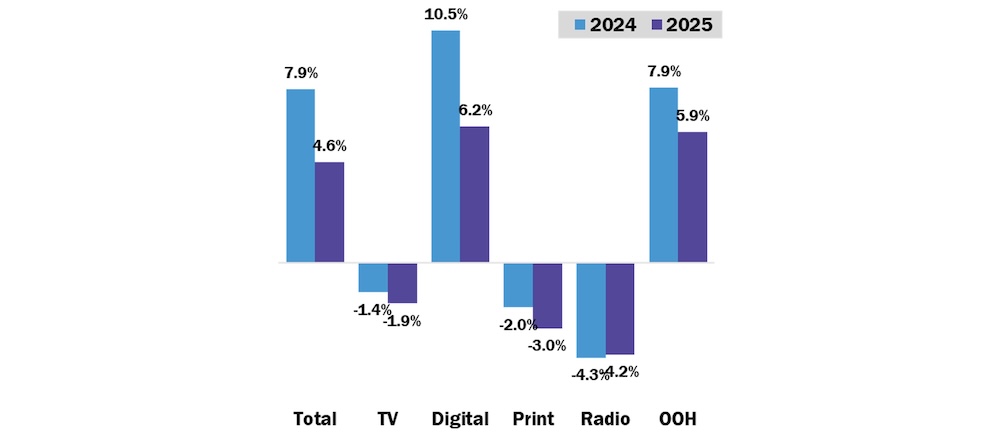

Overall APAC growth of +7.5% in 2024 consisted of traditional media owners seeing flat growth to reach $68 billion (24% of budgets), and digital pure player publishers seeing growth of +10.5% to reach $220 billion (76% of budgets). Television budgets were slightly negative in 2024, shrinking by -1.4%. While the increasing share of streaming revenues for TV broadcasters helps to cushion the declines in overall budgets, that cannot fully offset the trend of consumers shifting their attention from television to other formats. In 2024, TV spending was also buoyed by sporting events – primarily the Paris Olympics.

Digital Pure Players Taking Share

Digital advertising revenues are the driver of growth in APAC (as they are in most regions). Search remains the largest portion of digital advertising revenues and represented $100 billion in 2024. This represented 46% of total digital advertising budgets. Search advertising in APAC is substantially driven by retail media platforms, especially in China where Alibaba, JD.com, Pinduoduo, and Meituan all drive search advertising revenues. Core search is also spiking around the world as traditional search platforms like Google and Baidu also see strong performance relative to recent results. In 2025, search advertising growth will slow to +5.3% because of uncertainty from businesses and consumers around financial visibility. However, this will still represent an incremental $5bn+ of new budgets, trailing just social media for the largest portion of incremental spending.

Social media advertising revenue growth was strong in 2024 (+16.3%, leading growth). Social media revenues will grow by +9% in 2025, representing an incremental $7bn of new money in the APAC region. Both search and social media revenues are driven by mobile devices. Smartphones are not just the dominant way that most consumers access the internet; in many APAC markets they are the only way consumers access the internet. Many consumers skipped the desktop hardware generation and conduct their digital lives solely on their smartphones. Furthermore, in China consumers don’t just do shopping and communication on smartphones, but also banking, insurance, and many work functions.

The digital strength driving APAC advertising revenues will translate to continued share gains for digital advertising revenues in APAC. Digital revenues will represent 82% of total budgets in 2029, up from 76% of total advertising revenues in 2024.

Long-Term: Linear Falls Below 20%

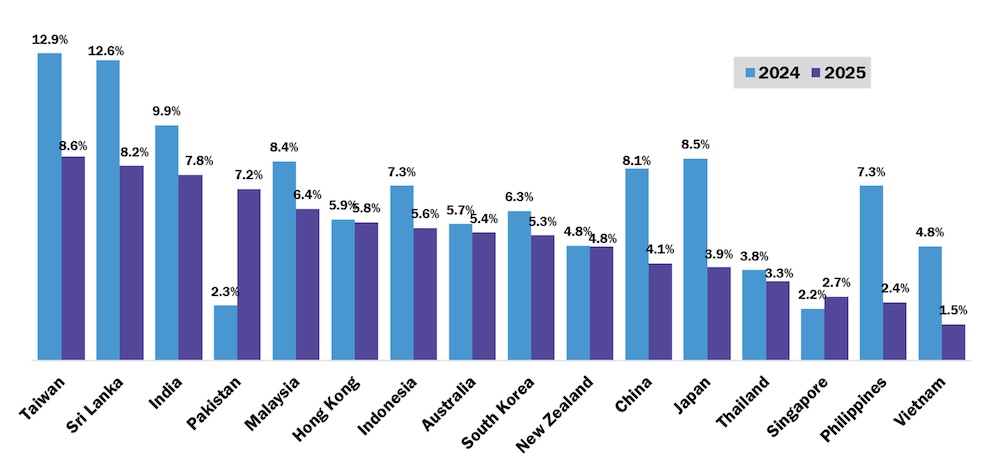

In 2024, the strongest growth in APAC came from Taiwan (+12.9%), Sri Lanka (+12.6%), and India (+9.9%). Weak advertising revenue growth, on the other hand, came from Singapore (+2.2%), Pakistan (+2.3%), and Thailand (+3.8%).

APAC as a region is still dominated by China, which represents more than half of total ad revenues. When combined with Japan, Australia, India, and South Korea, those five large markets represent 87% of total APAC revenues.

By 2029, the share of total revenues that are represented by linear advertising formats will have fallen to just 18%, representing just slightly fewer dollars ($64 billion) as they do today ($68 billion). Digital pure players, on the other hand, will represent 82% of total budgets and $294 billion, significantly higher than their 2024 total ($220 billion).

Says Vincent Létang, EVP, Global Market Research at MAGNA, and author of the report: “MAGNA had long anticipated a slowdown in the global advertising market in 2025 following an exceptionally strong 2024. However, the deterioration in the economic outlook and a decline in business confidence since our December update have prompted us to revise our full-year 2025 growth forecast downward by 1.2 percentage points, to +4.9%. So far, the slowdown has been relatively modest. Digital media, in particular, performed better than expected in the first quarter. MAGNA believes that the marketing industry has learned important lessons from the COVID period—recognizing the value of maintaining consistent communication and adopting balanced media strategies, especially during times of consumer uncertainty.”

APAC GROWTH BY MEDIA

FOCUS ON APAC

The advertising economy in Asia Pacific grew by +7.9% in 2024 to reach $288 billion. This took place in a stable economic environment, with real GDP increasing by +5.3% in 2024. While this growth is expected to slow slightly in 2025 to +4.5%, the growth environment has been conducive to brands deploying ad budgets. Inflation in APAC has continued to decline and while some economies are still seeing sustained price pressures, others are facing deflationary risks. While this was increasing the possibility of a soft landing for the Asian economy, there is now the threat of trade wars and geopolitical uncertainty that is causing additional hesitation from brands. This is one of the reasons why growth expectations in 2025 are significantly lower when it comes to ad spending (+4.6%, down from +7.9% growth in 2024).

Overall APAC growth of +7.5% in 2024 consisted of traditional media owners seeing flat growth to reach $68 billion (24% of budgets), and digital pure player publishers seeing growth of +10.5% to reach $220 billion (76% of budgets). Television budgets were slightly negative in 2024, shrinking by -1.4%. While the increasing share of streaming revenues for TV broadcasters helps to cushion the declines in overall budgets, that cannot fully offset the trend of consumers shifting their attention from television to other formats. In 2024, TV spending was also buoyed by sporting events – primarily the Paris Olympics.

Digital advertising revenues are the driver of growth in APAC (as they are in most regions). Search remains the largest portion of digital advertising revenues and represented $100 billion in 2024. This represented 46% of total digital advertising budgets. Search advertising in APAC is substantially driven by retail media platforms, especially in China where Alibaba, JD.com, Pinduoduo, and Meituan all drive search advertising revenues. Core search is also spiking around the world as traditional search platforms like Google and Baidu also see strong performance relative to recent results. In 2025, search advertising growth will slow to +5.3% because of uncertainty from businesses and consumers around financial visibility. However, this will still represent an incremental $5bn+ of new budgets, trailing just social media for the largest portion of incremental spending.

Social media advertising revenue growth was strong in 2024 (+16.3%, leading growth). Social media revenues will grow by +9% in 2025, representing an incremental $7bn of new money in the APAC region. Both search and social media revenues are driven by mobile devices. Smartphones are not just the dominant way that most consumers access the internet; in many APAC markets they are the only way consumers access the internet. Many consumers skipped the desktop hardware generation and conduct their digital lives solely on their smartphones. Furthermore, in China consumers don’t just do shopping and communication on smartphones, but also banking, insurance, and many work functions.

The digital strength driving APAC advertising revenues will translate to continued share gains for digital advertising revenues in APAC. Digital revenues will represent 82% of total budgets in 2029, up from 76% of total advertising revenues in 2024.

In 2024, the strongest growth in APAC came from Taiwan (+12.9%), Sri Lanka (+12.6%), and India (+9.9%). Weak advertising revenue growth, on the other hand, came from Singapore (+2.2%), Pakistan (+2.3%), and Thailand (+3.8%).

APAC as a region is still dominated by China, which represents more than half of total ad revenues. When combined with Japan, Australia, India, and South Korea, those five large markets represent 87% of total APAC revenues.

By 2029, the share of total revenues that are represented by linear advertising formats will have fallen to just 18%, representing just slightly fewer dollars ($64 billion) as they do today ($68 billion). Digital pure players, on the other hand, will represent 82% of total budgets and $294 billion, significantly higher than their 2024 total ($220 billion).

Says Leigh Terry, CEO IPG Mediabrands APAC: “The continued resilience and dynamism of the APAC advertising economy in 2024, growing by nearly 8%, reinforces the region’s strategic importance for global brands. As digital platforms increasingly become the primary gateway to consumers, especially in mobile-first markets, advertisers must evolve their strategies to meet where attention is shifting. While the outlook for 2025 is tempered by macroeconomic and geopolitical uncertainty, the underlying fundamentals remain strong. APAC’s digital transformation is far from complete, and for brands willing to invest smartly, the region still offers outsized growth opportunities.”

Says Paul Waller, Chief Investment Officer IPG Mediabrands APAC: “With fewer cyclical events in 2025, the projected global growth of +4.9% in 2025 is still noteworthy. As MAGNA reports, digital continues to be the engine of expansion and in APAC will represent 82% of total budgets in by 2029. Powered by mobile-first consumers and retail media innovation, especially in China, strategic allocation to these dynamic channels will be critical for brands navigating future complexities, ensuring sustained ROI and market relevance in an increasingly digital first APAC.”